Clinical Authority of Orthopedic Spine Specialists in Lumbar Surgery

Specialized Training and Fellowship Expertise Shaping Treatment Authority

Spine specialists in orthopedics typically spend around six to seven years after medical school getting trained, often going through specialized fellowships that focus specifically on problems related to the spine. All this extra education means they can handle really complicated situations like redoing previous surgeries or doing multiple level fusions something regular orthopedic surgeons tend to send their patients for about 58% of the time according to a study published in the Journal of Neurosurgery: Spine back in 2023. Because these specialists know so much about how spines work mechanically and what kind of implants perform best, hospitals actually stock up on devices that match what the specialists prefer. Most hospitals have noticed this trend over recent years.

Diagnosing Key Conditions: Degenerative Disc Disease, Herniated Discs, and Spinal Stenosis

Specialists demonstrate 32% higher diagnostic accuracy than generalists in distinguishing lumbar radiculopathy from non-spinal nerve compression (Neurological Research, 2024). This precision is critical when evaluating:

- Degenerative disc disease: Identifying instability via dynamic X-rays before recommending disc replacement systems

- Herniated discs: Deciding between endoscopic discectomy tools and open surgery instrumentation

- Spinal stenosis: Choosing expandable interlaminar spacers over traditional decompression techniques

These decisions significantly impact operating room supply chains, with 74% of hospital purchasing managers prioritizing devices validated by specialist-led clinical trials (Healthcare Procurement Quarterly).

Determining Surgical vs Nonsurgical Interventions for Lumbar Spine Disorders

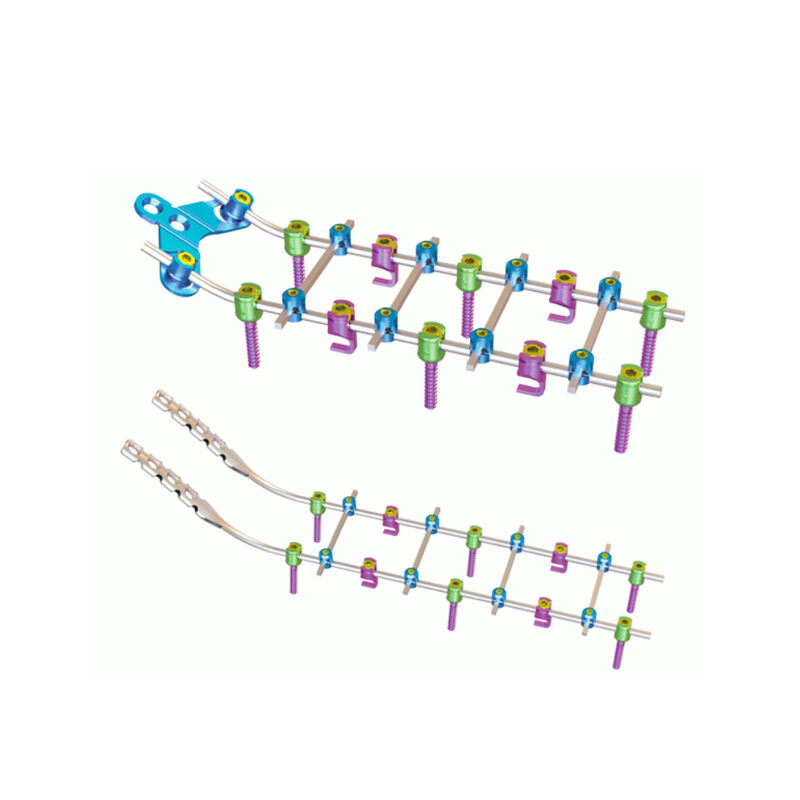

Most orthopedic spine doctors will only recommend surgery when there are obvious signs of nerve damage. For the majority of back pain cases (around 61%), they tend to go with less invasive options first, such as giving steroid shots or setting up physical therapy programs. This careful selection process helps avoid putting implants into people who don't really need them, and makes sure those fancy surgical tools get used where they're actually needed. When actual surgery becomes necessary, these specialists usually prefer going with modular screw and rod systems instead of just placing standalone cages. This choice affects hospital spending patterns quite a bit, pushing money towards what's called integrated spinal fixation platforms. According to recent market analysis reports, this particular area of orthopedic equipment is expected to see about 9.2% growth each year until at least 2027.

Direct Influence on Implant Selection and Vendor Preferences

Surgeon-Driven Implant Choices in Lumbar Spine Procedures

Orthopedic spine specialists directly control 68% of implant selection decisions in lumbar fusion surgeries (Journal of Neurosurgery: Spine, 2023). Their choices are informed by hands-on experience across 400+ annual spinal procedures, favoring implants with proven performance in:

- Intraoperative handling

- Postoperative fusion rates

- Long-term revision risk

This clinical authority compels vendors to tailor instrument designs to meet surgeon-specific workflow demands, with 92% of manufacturers reporting product modifications based on specialist feedback.

Role of Orthopedic Spine Specialists in Hospital Value Analysis Committees

Nearly 42% of Level 1 trauma centers include spine specialists on value analysis committees (Spine journal, 2022), where they advocate for outcome-based evaluation models that emphasize long-term success over upfront cost savings. The following table illustrates how surgeon and hospital priorities differ in device assessment:

| Metric | Surgeon Weighting | Hospital Weighting |

|---|---|---|

| 5-Year Complication Rate | 35% | 20% |

| Procedural Efficiency | 25% | 30% |

| Device Cost | 15% | 40% |

This collaborative model accelerates procurement, with leading teaching hospitals reporting 18% faster contract renewals when specialists co-lead decision-making teams.

Case Study: How Specialist Input Shapes Spine Device Formularies

A 2023 review of 12 academic medical centers found that institutions with active surgeon-led device review panels achieved:

- 27% reduction in implant-related complications

- 15% decrease in procedural costs

- 9% improvement in OR turnaround times

A hospital network somewhere in the Midwest cut down on inventory costs by getting rid of 19 duplicate spinal implant stock keeping units when doctors showed that patients had similar results no matter which brand was used. This change saved them around $2.1 million each year, money they put towards buying new robotic navigation equipment instead. Research published in JBJS Open Access backs up what many healthcare providers are already seeing happen. According to their findings, most hospitals today (about 76%) won't even consider adding a medical device to their list of approved products unless there's strong clinical proof behind it first.

Patient-Centered Decision-Making and Surgeon Leadership in Spine Care

Shared Decision Models in Lumbar Surgery: Balancing Patient Input and Clinical Expertise

Orthopedic spine specialists increasingly use shared decision-making frameworks to align surgical plans with patient goals. A 2024 analysis of 3,800 lumbar procedures found structured preoperative consultations reduced unnecessary surgeries by 18%, while maintaining 94% patient satisfaction (Patient-Reported Outcomes Measurement Information System). These discussions integrate:

- Objective imaging findings (e.g., disc herniation severity)

- Functional assessments (Oswestry Disability Index scores)

- Patient-reported quality-of-life objectives

Leading academic centers now require documentation of how patient preferences influenced implant selection and surgical planning–a practice associated with 22% fewer revisions over five years.

The Role of Second Opinions in Reinforcing or Redirecting Surgical Plans

Second opinions from spine specialists change initial treatment recommendations in 32% of complex lumbar cases (Spine Journal, 2023). While 58% of these changes shift care from surgical to nonoperative pathways, 41% refine procedural details such as:

- Surgical access routes (anterior vs. posterior approaches)

- Implant material selection (PEEK vs. titanium cages)

- Use of navigation-assisted techniques

This validation process reduces postoperative complications by 15%, yielding an average savings of $412,000 per 100 cases, while reinforcing surgeon leadership in coordinated care delivery.

Adoption of Advanced Technologies Driven by Spine Specialists

Growth of Minimally Invasive and Robotic-Guided Lumbar Spine Surgery

Orthopedic spine specialists now perform 62% of lumbar surgeries using minimally invasive techniques (Journal of Spinal Disorders, 2024), driving a 140% increase in robotic-assisted system adoption since 2021. These tools enhance pedicle screw placement accuracy, reducing revision rates by 37% compared to freehand methods in complex cases.

How Surgeon Experience Influences Procurement of Image-Guided and Robotic Systems

Hospital purchasing committees prioritize technologies evaluated by surgeons with 10+ years of experience, who lead 78% of new device assessments in academic centers. Facilities adopting surgeon-preferred systems achieve superior outcomes, as shown below:

| Metric | Robotic Systems | Traditional Methods |

|---|---|---|

| Average OR time reduction | 23% | 0% |

| Implant position accuracy | 98.4% | 89.1% |

This expertise-driven procurement model is now embedded in 82% of health system vendor contracts, creating a feedback loop where clinical validation directly shapes purchasing decisions for lumbar surgery technologies.

Balancing Clinical Demand and Economic Realities in Spine Procurement

The $11 billion spinal implant market faces growing pressure to balance innovation with fiscal responsibility, as premium devices see 5% annual price increases (2024 industry analysis). Orthopedic spine specialists increasingly influence procurement through outcome-based advocacy, while supply chain teams focus on cost containment–resulting in multidisciplinary value analysis committees guiding 80% of decisions.

Outcome-based purchasing in hospital supply chains for spinal implants

Seventy-four percent of U.S. health systems now tie spinal implant contracts to 2-year patient outcomes, requiring vendors to meet strict performance benchmarks:

| Metric | Performance Threshold |

|---|---|

| Revision surgery rates | â¿Â12% at 24 months |

| Average hospital stay | â¿Â3.2 days |

| Patient-reported pain scores | 30% improvement baseline |

This model empowers specialists to demand devices with fusion success rates exceeding 92% in degenerative cases, shifting competition from relationships to measurable efficacy.

Managing the tension between cost containment and specialist preference for premium devices

Despite divesting $1.1 billion in non-core spinal assets (2024 data), 83% of specialists continue specifying premium constructs for complex lumbar revisions. Leading health networks address this tension through:

- Tiered formularies requiring prior authorization for devices costing 150% above category averages

- Consortium purchasing models achieving 18–22% bulk discounts

- Surgeon-reported outcome dashboards linking device choice to 90-day readmission reductions

A 2024 analysis of 23,000 lumbar cases revealed that although premium implants increased initial costs by $4,800, they reduced 5-year revision expenses by $19,200–validating specialist preferences through total cost-of-care accounting.

FAQ

Why do orthopedic spine specialists spend extra years in training?

Orthopedic spine specialists undergo additional years of training and fellowships to handle complex spine issues, having expertise in specific procedures like multiple level fusions and redo surgeries.

How accurate are specialists in diagnosing lumbar conditions compared to generalists?

Specialists demonstrate 32% higher diagnostic accuracy than generalists in distinguishing lumbar-related issues from non-spinal nerve problems.

What role do spine specialists play in implant selection for surgeries?

Spine specialists have significant influence over implant selection during surgeries, controlling approximately 68% of implant decisions based on their expertise and hands-on experience.

How do specialists contribute to cost-effective spine care?

Specialists contribute by advocating for outcome-based device evaluations, leading to cost-effective procurement processes and reducing revision expenses through informed decision-making.

Why is shared decision-making important in lumbar surgeries?

Shared decision-making frameworks align surgical plans with patient goals, reducing unnecessary surgeries and improving patient satisfaction.

Table of Contents

- Clinical Authority of Orthopedic Spine Specialists in Lumbar Surgery

- Direct Influence on Implant Selection and Vendor Preferences

- Surgeon-Driven Implant Choices in Lumbar Spine Procedures

- Role of Orthopedic Spine Specialists in Hospital Value Analysis Committees

- Case Study: How Specialist Input Shapes Spine Device Formularies

- Patient-Centered Decision-Making and Surgeon Leadership in Spine Care

- Adoption of Advanced Technologies Driven by Spine Specialists

- Balancing Clinical Demand and Economic Realities in Spine Procurement

-

FAQ

- Why do orthopedic spine specialists spend extra years in training?

- How accurate are specialists in diagnosing lumbar conditions compared to generalists?

- What role do spine specialists play in implant selection for surgeries?

- How do specialists contribute to cost-effective spine care?

- Why is shared decision-making important in lumbar surgeries?

EN

EN

FR

FR

ES

ES

AR

AR