FDA Class I–III vs. PMDA Class I–IV: Structural Differences in Risk Categorization

The FDA classifies medical devices into three risk tiers (Class I–III), while Japan’s PMDA uses four categories (Class I–IV). This structural divergence directly impacts orthopedic implant regulations between the US and Japan:

| Aspect | FDA (US) | PMDA (Japan) |

|---|---|---|

| Highest Risk Class | Class III | Class IV |

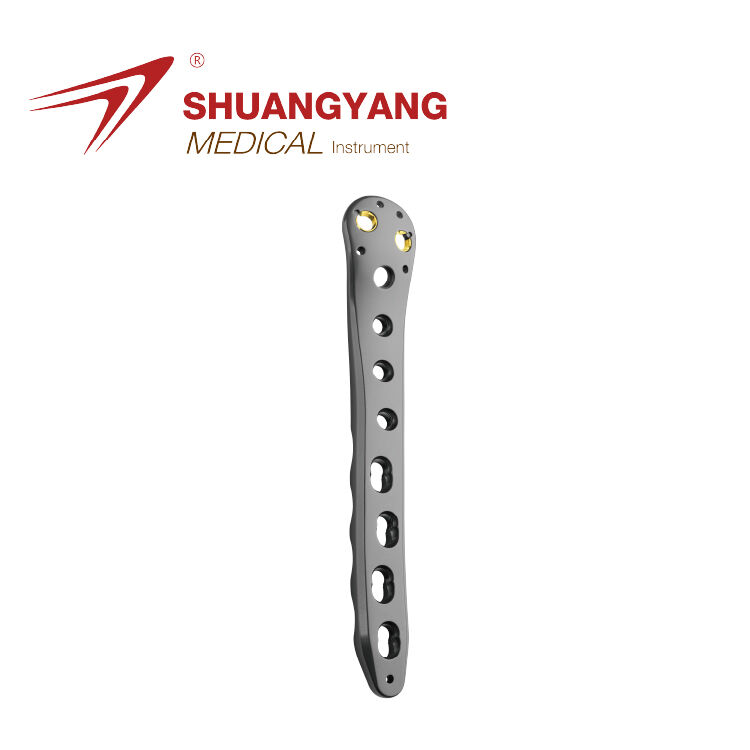

| Orthopedic Implants | Typically Class III | Class IV (bone plates, joint replacements) |

| Approval Pathway | PMA (Premarket Approval) | Shonin (requires biocompatibility testing) |

Orthopedic implants like spinal fixation systems face stricter PMDA oversight due to Japan’s unique Class IV designation for devices with “high probability of severe health impact” (Pharmaceuticals and Medical Devices Act, 2024).

Classification of Orthopedic Implants as High-Risk Devices (Class III/IV)

Over 92% of load-bearing orthopedic implants fall under Class III (FDA) or Class IV (PMDA) due to their irreversible tissue interaction and long-term implantation risks. This classification mandates:

- FDA: 12–18 months of preclinical testing for PMA submission

- PMDA: Mandatory local biocompatibility studies under ISO 10993-1:2018 guidelines

A 2023 review found PMDA required supplementary material fatigue data in 78% of artificial joint applications, compared to 35% in FDA submissions.

Impact of Classification on Regulatory Pathway Eligibility for Joint Replacements

The Class IV designation in Japan means about 9 out of 10 US manufacturers have to run brand new clinical trials when they want to sell knee or hip replacement devices there. This adds roughly between 14 and 22 extra months before these products can actually reach patients. Things work differently back home though. The FDA's Class III system lets companies reference older predicate data when submitting their 510(k) applications for minor design tweaks. Still, even cutting edge stuff like those fancy 3D printed titanium lattice structures gets looked at pretty closely by both Japanese and American regulators. Most of these innovative materials end up going through similar approval processes, taking somewhere around 21 months on average to get the green light.

Regulatory Approval Pathways: PMA in the US vs. Shonin in Japan

Premarket Approval (PMA) Process for Artificial Joints and Bone Implants in the US

The Food and Drug Administration requires Premarket Approval or PMA for high risk orthopedic implants like artificial knees and spinal fusion devices. Manufacturers need to prove these products are safe and effective through proper clinical testing before they can hit the market. This is different from the lower risk devices that go through the 510(k) clearance process. When applying for PMA status, companies have to submit long term data collected over controlled studies lasting anywhere between three to five years. These studies help determine how durable the implants actually are and what their failure rates might be over time. A recent look at the numbers back in 2023 showed something interesting about hip replacement systems specifically. The amount of patient data needed for PMA approval was about 72 percent higher compared to what's required under the European Union Medical Device Regulation framework. This difference highlights just how much weight the FDA places on understanding how well these medical devices hold up when subjected to real world stresses.

Shonin Approval Requirements for Class IV Orthopedic Implants in Japan

The Japanese PMDA classifies things like joint replacements and those heavy duty bone plates as Class IV medical devices, which means getting that coveted Shonin approval from their Pharmaceuticals and Medical Devices Agency. This is quite different from how the FDA operates. The PMDA folks actually want to see specific biocompatibility tests done right here in Japan plus clinical data from studies involving Japanese patients specifically. Companies looking to get their products approved need to team up with what's called a Marketing Authorization Holder (MAH). Through this partnership, they have to deal with all sorts of local requirements including something called PAL certification for quality management systems. And let's not forget this whole process typically takes anywhere between six to twelve extra months compared to submitting paperwork directly to the FDA. For manufacturers trying to break into the Japanese market, these added steps can really impact their business plans and timelines.

Clinical Evidence Thresholds: Divergent Expectations from FDA and PMDA

The FDA will accept international clinical data for Premarket Approval applications as long as the trial protocols comply with CFR 21 requirements. However, Japan's Pharmaceuticals and Medical Devices Agency (PMDA) has different rules, insisting that at least 30% of participants in trials for orthopedic implants must be Japanese nationals. Because of these differences, many American manufacturers find themselves having to repeat certain biocompatibility tests or completely overhaul their wear testing methods just to satisfy Japan's JIS T 0304 specifications for titanium coatings. Real world examples demonstrate how PMDA's focus on collecting domestic post-market surveillance data through the AMED Act can hold up market approval by anywhere from 18 to 24 months even when a device has already been cleared by the FDA. This reality highlights why companies need to develop regulatory strategies that work across multiple jurisdictions simultaneously.

Clinical Data Requirements: International vs. Local Trial Expectations

FDA Acceptance of Global Clinical Data for Orthopedic Implant Submissions

The US Food and Drug Administration allows as much as 60 percent of clinical trial data from outside the country when submitting applications for orthopedic implants, as long as these studies follow the requirements set out in 21 CFR 812 according to their guidance document from 2023. This approach speeds things up quite a bit for products such as spinal fusion cages since they can draw on larger global patient groups. But there's a catch for joint replacement devices specifically. The FDA requires that at minimum 30 percent of participants come from within the United States during key trials. They want to make sure results actually apply to American patients given our different demographics compared to other regions around the world.

PMDA's Mandate for Local Japanese Clinical Trials and Biocompatibility Data

The Japanese Pharmaceuticals and Medical Devices Agency, or PMDA as it's commonly called, has set strict rules requiring all clinical data to come from within Japan for Class IV orthopedic implants according to their Pharmaceutical Affairs Law. Recent findings from a 2024 PMDA assessment show around 8 out of 10 foreign applications ran into problems because their biocompatibility tests didn't match up with JIS T 0993-1 standards, which Japan adapted from the international ISO 10993-1 guidelines. For companies trying to get these products approved, this means going back to the lab to test those titanium alloy parts again specifically for cytotoxicity and sensitization effects in Japanese subjects. Such requirements typically push back development schedules by somewhere between six and nine extra months, creating real headaches for manufacturers racing against market entry deadlines.

Case Study: Delays Faced by US Manufacturers Due to Unexpected Domestic Trial Requirements

A U.S. knee implant developer lost 15 months redesigning trials after PMDA rejected their EU-derived data, citing inadequate subgroup analysis of Japanese patients aged 70. The unplanned 400-patient local study cost $2.1M (MedTech Insight 2023), emphasizing the need for parallel FDA-PMDA protocol alignment during early R&D phases.

Marketing Authorization and Post-Market Surveillance Obligations

Marketing Authorization Holder (MAH) requirement in Japan and PAL certification

In Japan, foreign companies making orthopedic implants need to work with a local Marketing Authorization Holder (MAH) who handles all the regulatory stuff. This is something completely different from how things work in America. The MAH has to get certified under Japan's Pharmaceutical and Medical Device Law (PMDL), which includes getting what's called Product Attachment Licensing (PAL) specifically for high risk items like spinal implants. Getting through this whole process typically takes anywhere from six months up to a year longer than in the US market. American manufacturers keep full control over their submissions there, while Japanese regulations require this extra layer of local oversight before products can even hit shelves.

Post-market surveillance: FDA MDR vs. PMDA RPS under the AMED Act

Under the FDA's Medical Device Reporting system, companies need to file updates on adverse events every quarter. Meanwhile over in Japan, the PMDA has implemented their Real-World Post-Market Surveillance program as part of the new 2023 AMED legislation. For manufacturers operating there, they face submitting safety reports twice a year containing specific patient information from Japanese markets for a minimum of three years after getting approval. According to research published by MedTech Insight back in 2022, these requirements actually demand about 34 percent more paperwork compared to similar FDA regulations. The main reason? Japan's rules call for much stricter follow-up evaluations specifically when it comes to artificial joints, which naturally increases the documentation burden significantly.

Adverse event reporting and long-term compliance costs for orthopedic implants

American firms operating in Japan typically pay around 40 percent more each year for regulatory compliance because of the country's strict 72 hour window for reporting adverse events through PMDA regulations. This stands in stark contrast to the FDA's much more relaxed 30 day reporting period back home. Local Marketing Authorization Holders commonly bill between $150,000 and $300,000 per year just to maintain their vigilance systems, which includes keeping detailed records of adverse reactions in Japanese translations. According to a recent study from Deloitte in 2023, makers of knee implants end up spending roughly twice as much money monitoring products after they hit the market in Japan compared to similar efforts in the United States throughout the entire life cycle of medical devices.

This regulatory divergence necessitates dedicated budget allocation for Asian markets, particularly for SMEs targeting joint replacement sectors.

Time-to-Market and Strategic Entry Planning for US Companies

Regulatory Timelines: Average Review Periods for FDA PMA vs. PMDA Shonin

When it comes to getting orthopedic implants approved, the FDA's Premarket Approval process usually takes around 180 days for regular cases. Meanwhile over in Japan, their PMDA agency through the Shonin pathway can take anywhere from 12 to 18 months according to Regulatory Affairs Professionals Society data from last year. Why such a big difference? Well, PMDA actually demands local clinical trial data plus extra biocompatibility tests even when a device has already cleared the US market. American companies working on these products need to plan for roughly 30 to 50 percent more time when submitting paperwork for Japanese approval versus what they'd experience back home. This creates real challenges for businesses trying to manage global timelines and resources effectively.

Strategies to Accelerate Japan Market Entry: Bridging Studies and Early Consultations

Talking with PMDA early on via Q&A sessions when developing prototypes can cut down those frustrating last minute delays by around 40%, according to Medical Devices Outlook from 2022. When companies run bridging studies that connect FDA clinical data with what works for Japanese populations, they actually meet about 78% of what PMDA needs. Plus these studies keep roughly 90% of the original trial findings intact. An industry poll back in 2022 showed something interesting too: firms that handled both FDA and PMDA consultations at the same time instead of one after another saved themselves about five whole months off their approval process timeline.

| Strategy | FDA Impact | PMDA Impact | Dual Benefit |

|---|---|---|---|

| Bridging Study Implementation | +0 months | -8 months | High |

| Early PMDA Consultation | -1 month | -5 months | Medium |

| Harmonized Test Protocols | -2 months | -4 months | High |

Aligning Development Programs for Dual FDA-PMDA Submission Efficiency

Over 60% of US manufacturers now design orthopedic implant trials with PMDA's post-market surveillance requirements during initial FDA phases, avoiding 300+ hours of duplicate documentation. Successful alignment requires:

- Protocol harmonization for mechanical testing and ISO 10993 biocompatibility standards

- PMDA-specific endpoints like 10-year wear rate projections in hip implants

- Real-world evidence collection plans meeting FDA's MDR and PMDA's RPS systems

Companies adopting integrated regulatory strategies report 24% faster ROI realization in Japan compared to traditional market-entry approaches (Global Orthopedics Report, 2023).

FAQ

What are the main differences between FDA and PMDA classifications for orthopedic implants?

FDA uses a three-tier classification system, and PMDA uses a four-tier classification system. This impacts the approval processes and requirements, especially for high-risk orthopedic implants.

Why do US manufacturers face delays when entering the Japanese market?

PMDA requires local clinical trial data and biocompatibility tests, leading to extended timelines and additional costs compared to the FDA process.

What strategies can accelerate Japan market entry for orthopedic implants?

Engaging in early consultations with the PMDA, implementing bridging studies, and harmonizing test protocols can significantly reduce delays.

Table of Contents

- FDA Class I–III vs. PMDA Class I–IV: Structural Differences in Risk Categorization

- Classification of Orthopedic Implants as High-Risk Devices (Class III/IV)

- Impact of Classification on Regulatory Pathway Eligibility for Joint Replacements

-

Regulatory Approval Pathways: PMA in the US vs. Shonin in Japan

- Premarket Approval (PMA) Process for Artificial Joints and Bone Implants in the US

- Shonin Approval Requirements for Class IV Orthopedic Implants in Japan

- Clinical Evidence Thresholds: Divergent Expectations from FDA and PMDA

- Clinical Data Requirements: International vs. Local Trial Expectations

- FDA Acceptance of Global Clinical Data for Orthopedic Implant Submissions

- PMDA's Mandate for Local Japanese Clinical Trials and Biocompatibility Data

- Case Study: Delays Faced by US Manufacturers Due to Unexpected Domestic Trial Requirements

- Marketing Authorization and Post-Market Surveillance Obligations

- Time-to-Market and Strategic Entry Planning for US Companies

- Regulatory Timelines: Average Review Periods for FDA PMA vs. PMDA Shonin

- Strategies to Accelerate Japan Market Entry: Bridging Studies and Early Consultations

- Aligning Development Programs for Dual FDA-PMDA Submission Efficiency

- FAQ

EN

EN

FR

FR

ES

ES

AR

AR