The Gatekeeper Role of Reimbursement Policies in Spinal Fusion Adoption

The way money flows through healthcare acts as the main control point for how widely spinal fusion gets used across American medical facilities. Insurance companies and government programs basically decide what treatments catch on, what equipment ends up in hospital operating rooms, and who actually gets treated. The payment rules set by Medicare, Medicaid, and private insurers draw lines in the sand that sometimes ignore what doctors recommend clinically. This happens especially when insurers pay better for traditional fusion surgeries compared to newer options that might work just as well or even better for patients.

CMS Payment Rates and Their Direct Impact on Lumbar Fusion Volume

How much Medicare pays for procedures has a big impact on how many lumbar fusions get done because money talks in healthcare. When the Centers for Medicare & Medicaid Services (CMS) pays more for spinal fusion than they do for options like artificial disc replacement (ADR), doctors naturally gravitate toward fusion even though ADR tends to need fewer follow-up surgeries. This difference in payments creates a real problem across the system. Hospitals start expanding their fusion capabilities just to make more money, while surgeons deal with paperwork and approval processes that somehow always work better for fusion cases. Looking at the numbers shows this connection clearly too. Whenever Medicare raises its payment rates by about 10%, we tend to see around 5 to 7 percent more people getting fused spines. What gets lost in all this math is whether these procedures are actually right for patients, especially older adults who rely on Medicare coverage since their access to treatment basically depends on what insurance will pay for.

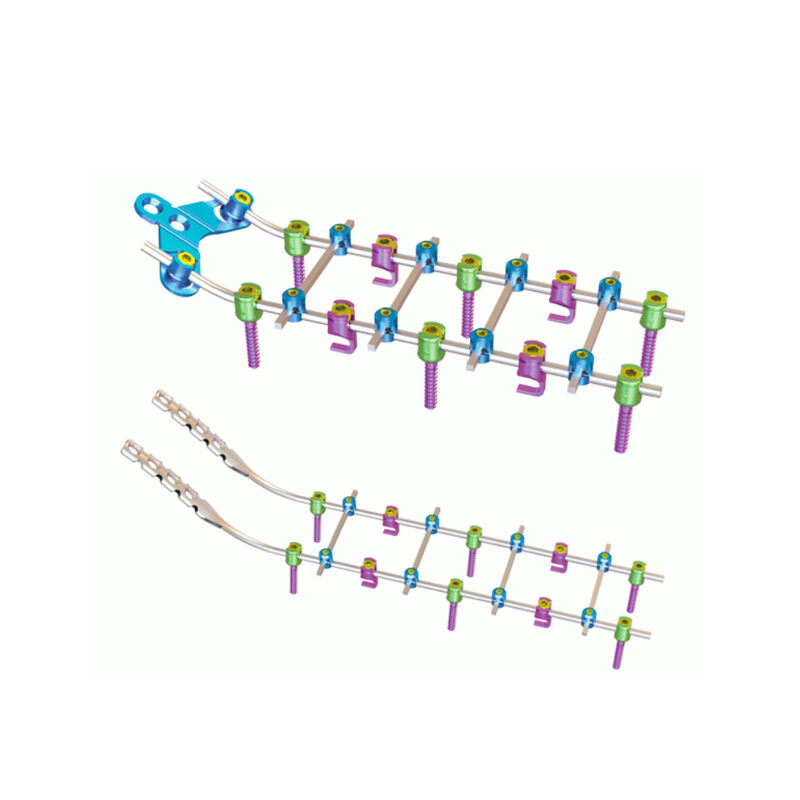

DRG Adjustments and Their Influence on Implant Selection and Surgical Decision-Making

DRG payment systems have really changed how implants are chosen for spinal fusion procedures. With fixed payments per case, hospitals tend to stick to standard implant protocols that save money, which means premium biologics often get left out even though they work better according to studies. When DRG rates drop, we see around 12 to 15 percent more use of generic hardware and less reliance on those expensive biological products. Money issues affect what happens in the operating room too. Surgeons find themselves following hospital rules that push for simple single-level fusions instead of complicated reconstructions. Minimally invasive methods become more popular simply because they consume fewer resources. At the end of the day, these payment structures turn medical decisions into budgetary exercises where what's affordable usually beats what's best for the patient when it comes to picking implants.

Bundled Payments and Value-Based Models: Reshaping Spinal Fusion Incentives

How Bundled Payment Initiatives Alter Hospital and Surgeon Behavior Around Fusion Cases

Payment models that cover just one episode of care are pushing hospitals toward spinal fusion approaches that save money. With bundled payment arrangements becoming more common, ambulatory surgery centers prefer implants that allow patients to go home the same day. Meanwhile, hospitals are spending big on robotic guidance systems which studies suggest can cut down on repeat surgeries around 2.3 percent. What we're seeing here actually creates three main shifts in how things get done. First off, surgeons are picking out implants that work better with quicker recovery times. Second, medical facilities are bundling their purchases from suppliers to get those bulk discount rates. And third, the data analysts are keeping tabs on how different implants perform when looking at total costs over 90 days. Looking at worldwide numbers, the spinal fusion business seems to be following this path too. Market forecasts point to roughly 4.2% annual growth until 2035 as more orthopedic practices move away from traditional fee-for-service models.

Workers’ Compensation Policies as a Critical Subsegment in Spinal Fusion Adoption

The way occupational injuries are handled actually speeds up the acceptance of spinal fusion procedures because of special payment routes. Most state worker comp programs (around 78%) require fusion treatment for certain back injuries at work, which means no waiting around for approvals like regular insurance does. What happens next is pretty interesting: we see a whole niche market developing where doctors use fast installation implants and data analysis tools to get patients back on their feet quicker. Insurance companies throw their weight behind outpatient fusions in surgical centers too, offering 12 to 18 percent extra money in premiums. For tech companies looking to break into the medical field, this particular area has become something of a goldmine lately.

Coverage Restrictions and Evidence Requirements: Barriers to New Fusion Technology Adoption

Coverage with Evidence Development (CED) and Its Delaying Effect on Novel Fusion Devices

The Coverage with Evidence Development (CED) rules require manufacturers to gather tons of real world data on new spinal fusion tech before getting approved by Medicare and other insurers. What happens next? Manufacturers end up stuck in a waiting game that usually takes around three to five years of expensive market tracking, all while their products sit on shelves gathering dust even after passing FDA standards. The price tag for generating this evidence runs about $740,000 per device, which hits especially hard for companies working on solutions for complicated spine issues where older implants tend to fail more often. Doctors find themselves limited in what they can offer patients, even when initial studies point to better load handling or fewer problems at neighboring vertebrae. Insurance companies focus so much on short term costs that they miss out on innovative treatments that could actually save money down the road by reducing the need for repeat surgeries. Because of these gaps in evidence, many healthcare providers continue using outdated equipment, despite research showing these older devices have roughly 40% higher failure rates over ten years in cases involving multiple fused levels.

Clinical Outcomes vs. Payer Priorities: Navigating the Cost-Effectiveness Threshold for Spinal Fusion

Spinal fusion surgeons are caught in a tough spot these days. They need to show good results with things like successful bone fusion and pain relief while also meeting insurance companies' strict cost requirements. Research indicates that lumbar fusion surgery actually gives patients about 0.4 to 1.2 extra quality adjusted life years compared to just treating back pain without surgery. But insurers tend to focus on what they spend right now rather than thinking about money saved down the road. We see this conflict clearly when it comes to new treatments or advanced surgical methods. These innovations might lead to 15 to 30 percent better outcomes for patients, yet hospitals still get denied payment unless there's solid evidence from multiple years of actual practice. Hospitals have started making deals where they share financial risks or created lists of approved implants based mainly on how much they cost each month instead of what's best for healing. To work through all this mess, medical teams must gather proof that their procedures work well clinically AND make sense financially. Looking at numbers like low repeat surgery rates (around 5% or less after five years) and faster times until workers can go back to jobs helps convince everyone involved that spending money now pays off later.

FAQ Section

What is the main factor influencing spinal fusion adoption in the U.S.?

Reimbursement policies from insurance companies and government programs primarily dictate the adoption of spinal fusion techniques in the U.S. These policies define which treatments are preferred based on financial incentives.

How do CMS payment rates impact lumbar fusion procedures?

Higher CMS payment rates for spinal fusion can lead to an increase in such procedures, as they provide financial incentives for healthcare providers compared to alternative treatments that might be cheaper to perform.

What role do DRG adjustments play in spinal fusion surgeries?

DRG payment systems influence decisions by encouraging the use of cost-effective implants, often prioritizing cheaper hardware over premium biologics due to case-based fixed payments.

How do workers' compensation policies affect spinal fusion adoption?

Workers' compensation programs often expedite the adoption of spinal fusion treatments for work-related injuries, creating niche markets where faster and more efficient implant solutions are developed.

What challenges do new spinal fusion technologies face?

New technologies often face barriers like the need for extensive evidence development, which delays their adoption despite FDA approval. These barriers are due to stringent reimbursement policies.

Table of Contents

- The Gatekeeper Role of Reimbursement Policies in Spinal Fusion Adoption

- Bundled Payments and Value-Based Models: Reshaping Spinal Fusion Incentives

- Coverage Restrictions and Evidence Requirements: Barriers to New Fusion Technology Adoption

- Clinical Outcomes vs. Payer Priorities: Navigating the Cost-Effectiveness Threshold for Spinal Fusion

-

FAQ Section

- What is the main factor influencing spinal fusion adoption in the U.S.?

- How do CMS payment rates impact lumbar fusion procedures?

- What role do DRG adjustments play in spinal fusion surgeries?

- How do workers' compensation policies affect spinal fusion adoption?

- What challenges do new spinal fusion technologies face?

EN

EN

FR

FR

ES

ES

AR

AR